Understanding Vacancy Rates in Japan’s Real Estate Investment Market,2024: A Guide for Condominium Investors”

Get information on Japanese real estate investment (investment condominium) with「 Dr.Asset Recommender! 」You can also check earthquake and flood risks.

「Dr.Asset Recommender」 is a service for those looking to purchase used condominiums, both for investment and personal use. Not only can you receive information on Japanese real estate investment (investment condominium), but you can also learn about earthquake risks (building collapse risk, fire risk, and difficulty of disaster response). Start by registering today!

Sign up here → “Dr.Asset Recommender”

Registration is free, and there are no fees until you actually purchase a property.

What is “Dr.Asset Recommender”?

It’s a service that sends property listings matching your desired criteria directly to your email, without the need to visit a real estate office. It also provides valuable content such as market prices, safety information, earthquake risks, and AI-predicted rental yields (in case you decide to rent out the property). With “Dr.Asset Recommender,” you can receive property information that matches your preferences straight to your inbox!

Benefits of “Dr.Asset Recommender”:

- Receive property information that matches your preferences via email

- Access to market price data

- Get insights into the local crime risks

- Understand earthquake and flood risks

- View sales history of the specific condominium

- Compare sales history of similar condominiums in the area

These are just some of the great features our service offer

<Related Articles>

How to Use 「Dr.Asset」: Get the Best Real Estate Investment (Investment Condominium) Deals in Japan

目次

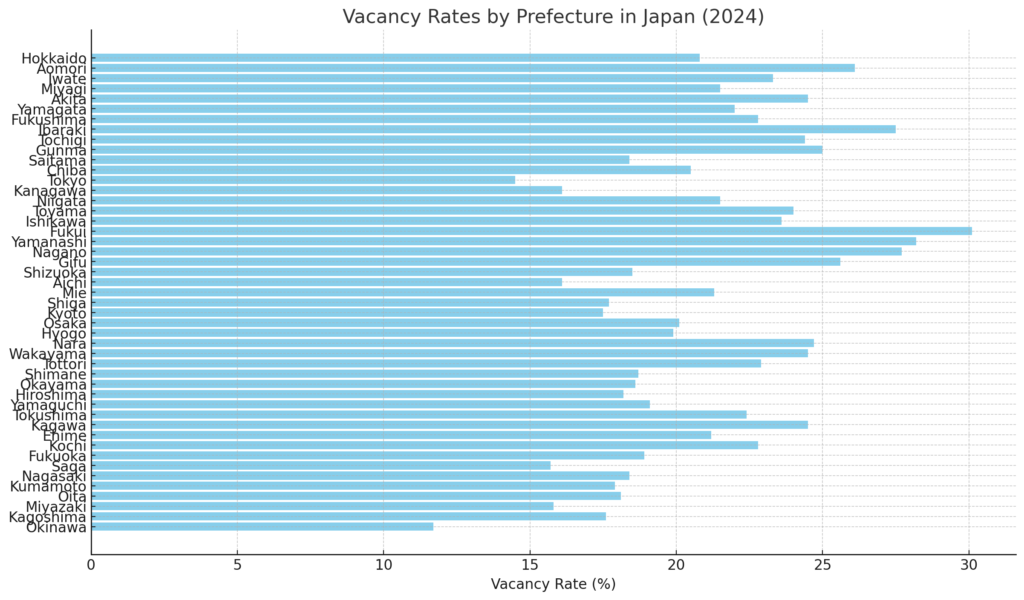

Vacancy Rates by Prefecture, 2024

引用:https://toushi.homes.co.jp/owner/ HOMES 2024年10月

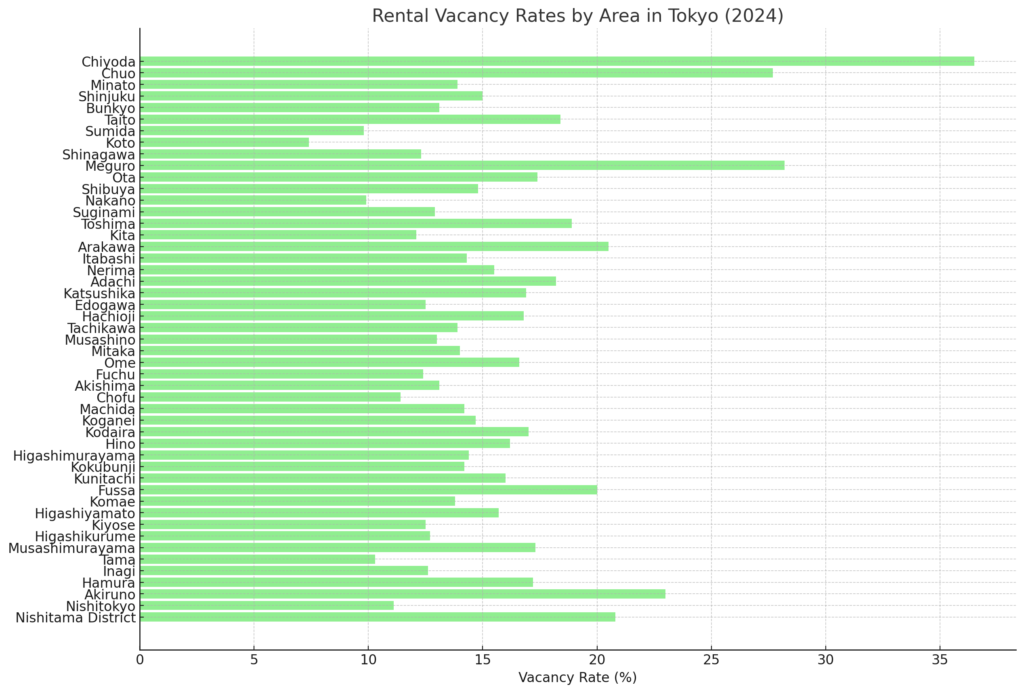

The overall trend of Tokyo’s vacancy rates

引用:Tokyo’s vacancy rates https://toushi.homes.co.jp/owner/tokyo/

The vacancy rates of rental properties in Tokyo vary significantly by region. Central urban areas and regions with high convenience tend to have relatively low vacancy rates, while suburban and rural areas exhibit higher vacancy rates.

- Regions with the highest vacancy rates: Chiyoda Ward (36.5%), Meguro Ward (28.2%), and Chuo Ward (27.7%) show higher vacancy rates. Particularly in Chiyoda Ward, despite being centrally located, there is less residential demand compared to other wards due to the prevalence of office buildings.

- Regions with the lowest vacancy rates: Koto Ward (7.4%), Sumida Ward (9.8%), and Nakano Ward (9.9%) have relatively low vacancy rates, suggesting stable rental demand.

2. Vacancy Rates in Central and Southern Areas

Areas in southern Tokyo, such as Minato Ward (13.9%) and Shinagawa Ward (12.3%), have relatively low vacancy rates. These areas are business hubs with high residential demand, making it easier to fill rental properties. Similarly, in highly convenient areas like Shibuya Ward (14.8%) and Shinjuku Ward (15.0%), vacancy rates are also low.

3. Vacancy Rates in Suburban Areas

In suburban areas, especially in the western parts of Tokyo, vacancy rates tend to be higher. For example, Akiruno City (23.0%) and Nishitama District (20.8%) have higher vacancy rates, indicating lower demand for rental properties. These areas may have less convenient transportation access to central Tokyo and smaller populations, which likely contributes to the higher vacancy rates.

4. Highly Competitive Areas

In some areas like Arakawa Ward (20.5%) and Fussa City (20.0%), vacancy rates exceed 20%. These regions may face fierce competition with other rental properties, and if there are challenges with living environments or convenience, vacancy rates tend to rise.

5. Areas with Stable Vacancy Rates

Areas such as Tama City (10.3%) and Nishi-Tokyo City (11.1%) have relatively low vacancy rates due to their reasonable access to central Tokyo. These areas are popular with families and younger households, suggesting a stable rental market.

6. Summary and Future Challenges

- High vacancy rates in central Tokyo: In office-heavy areas like Chiyoda Ward, the number of residents is lower, leading to higher vacancy rates. These areas tend to have more commercial demand rather than residential.

- Low vacancy rates in convenient areas: Popular areas like Shibuya, Shinjuku, and Koto Wards show lower vacancy rates as rental properties are quickly filled. In areas where population growth is expected, rental demand will likely remain high.

- Challenges in reducing vacancy rates in suburban areas: In suburban areas like Nishitama District and Akiruno City, high vacancy rates suggest a need for infrastructure development and enhancements to rental property appeal to stimulate demand.

Must-Know Tips for Real Estate Investors! Maximizing Rental Income by Reducing Vacancy Rates Below 20%

1. Common Questions About Vacancy Rates

As a rental property owner, you may have the following questions:

- “What is the ideal vacancy rate for rental properties?”

- “Is the vacancy rate for my property too high?”

- “How full are nearby properties?”

In rental management, vacancy rates are closely tied to an owner’s income, making them a constant concern. In fact, many owners find themselves worried about vacancy rates.

2. The National Vacancy Rate Benchmark is Around 20%

Generally, the national benchmark for vacancy rates is around 20%. This figure is an average based on national data and varies depending on the region and type of property. However, if your vacancy rate exceeds 20%, it can become a cause for concern in terms of financial stability.

For instance, if your property has a vacancy rate of 20% in an area where the average is only 15%, you’ll notice a significant difference in profitability compared to nearby properties. Therefore, a 20% vacancy rate should not give you peace of mind—you should strive to reduce it as much as possible.

3. Tips for Reducing Vacancy Rates

A vacancy rate above 20% poses risks for property management. Here are some strategies to lower your vacancy rate:

3-1. Check Population Levels in Your Area

Vacancy rates tend to be higher in areas with a declining population, especially in rural or depopulated regions. When fewer people live in the area, rental demand decreases.

3-2. Research Nearby Competitors

If there are many competing properties in your area, potential tenants may choose other options. If nearby properties are newer or have better amenities, or if their rent is lower, this could affect your occupancy rates.

3-3. Adjust Rent Prices Accordingly

If rent is set too high, it may deter potential tenants. Compare your prices with nearby properties to ensure your rent is competitive.

4. Specific Strategies to Lower Vacancy Rates

Here are some practical steps you can take to reduce vacancies:

- Improve Property Maintenance: A well-maintained property is more attractive to tenants.

- Reevaluate Rental Terms: Consider offering incentives such as free rent for a certain period or lowering the security deposit.

- Renovate and Upgrade Facilities: With the rise of remote work, there is increased demand for larger living spaces and separate bathrooms. Enhancing your property’s appeal will make it more competitive.

5. The Importance of Keeping Vacancy Rates Low

Finally, by reducing your vacancy rate to below 20%, you can significantly improve profitability. Lower vacancy rates lead to more stable income, higher property value, and better opportunities for future investments. Consistently working to reduce vacancy rates is key to successful rental management.

This version of the blog post should help property owners understand vacancy rates and strategies to reduce them, ultimately enhancing profitability and stability in rental property management.

Get information on Japanese real estate investment (investment condominium) with「 Dr.Asset Recommender! 」You can also check earthquake and flood risks.

「Dr.Asset Recommender」 is a service for those looking to purchase used condominiums, both for investment and personal use. Not only can you receive information on Japanese real estate investment (investment condominium), but you can also learn about earthquake risks (building collapse risk, fire risk, and difficulty of disaster response). Start by registering today!

Sign up here → “Dr.Asset Recommender”

Registration is free, and there are no fees until you actually purchase a property.

What is “Dr.Asset Recommender”?

It’s a service that sends property listings matching your desired criteria directly to your email, without the need to visit a real estate office. It also provides valuable content such as market prices, safety information, earthquake risks, and AI-predicted rental yields (in case you decide to rent out the property). With “Dr.Asset Recommender,” you can receive property information that matches your preferences straight to your inbox!

Benefits of “Dr.Asset Recommender”:

- Receive property information that matches your preferences via email

- Access to market price data

- Get insights into the local crime risks

- Understand earthquake and flood risks

- View sales history of the specific condominium

- Compare sales history of similar condominiums in the area

These are just some of the great features our service offer

<Related Articles>

How to Use 「Dr.Asset」: Get the Best Real Estate Investment (Investment Condominium) Deals in Japan